Berkshire Hathaway, led by prominent investor Warren Buffett, has sold a stake in Visa and MasterCard, and Nubank, Brazil’s largest fintech bank, is also popular with Bitcoin investors. Invested.

Berkshire Hathaway’s financial report states that it bought $ 1 billion worth of Newbank Class A shares in the fourth quarter of last year for $ 1.8 billion and $ 1.3 billion, respectively. It has sold shares of Visa and MasterCard companies. This indicates that the company’s policies are moving away from payment facilitators such as Visa and MasterCard, and instead connecting with other Fintech competitors.

Buffett, also known as Oracle Omaha, is known for his cautious approach to investing, especially in sectors such as the Fintech market. It is interesting to note that this veteran investor downplays emerging decentralized financial solutions such as bitcoin and has ridiculed them many times.

However, Berkshire’s new investment may indicate a change in Warren Buffett’s behavior and a softer approach to Fintech. Baft had previously invested $ 500 million in the bank in July last year, earning $ 150 million with the Newbank listing on the New York Stock Exchange.

It is noteworthy that Baft has so far shown no interest in selling its Nobank shares.

Connection of texture and bitcoin

Buffett’s reinvestment in Nobank shares reflects his recognition of FinTech, the digitization of financial services, and his willingness to connect with companies that are somehow related to Ramzarz .

Nubank acquired Easynvest trading platform in September. The platform has been actively offering a bitcoin tradable fund (ETF) called QBTC11 on B3 since June 2021. It is interesting to know that B3 stock exchange is the second oldest stock exchange in Brazil.

So, despite calling Bitcoin a “mouse death” a few years ago, it seems that Nobank, which is still somehow connected to the emerging cryptocurrency market through the Easynvest platform, could take advantage of additional monetization opportunities to benefit its main investor, namely Warren Buffett use.

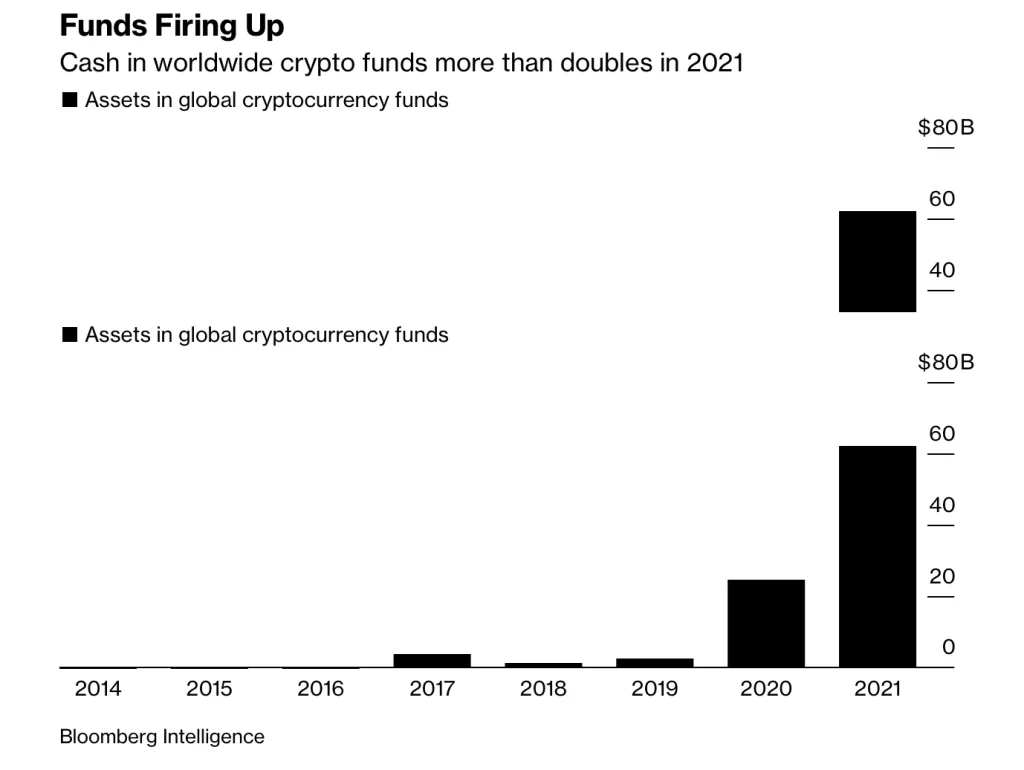

Warren Buffett’s recent investment in a bank that is somehow related to Bitcoin and the crypto sector is primarily due to the growth of investment products related to this sector in recent years. During 2021, the number of these products doubled from 35 to 80, while the total valuation of their assets increased from $ 24 billion at the beginning of the year to $ 63 billion.

Emily Portney, CFO of Melon Bank of New York, another bank in which Warren Buffett has invested, believes digital assets could be a “significant source of revenue” for banking and investment companies as bitcoin investing tools are evolving. Enter the mainstream market.

Meanwhile, Leah Wald, CEO of Valkyrie Investments, a digital asset management company, predicts that capital flows to cryptocurrency-related investment products will increase dramatically as these products begin to grow:

If you look at the inflow of capital from a volumetric point of view, you will find that not only have they been stable despite the price fluctuations and corrections known as Bitcoin, but also a jump in the amount of capital allocated by some organizations and their entry into the market. We have been.

Warren Buffett’s investment portfolio is filled with companies that love Ramzars

While Buffett may never invest directly in Bitcoin , he is indirectly involved with the market through the companies in which he has invested.

For example, in October last year, just one month before the price of Bitcoin peaked at $ 69,000, US Bancorp, the fifth largest bank in the United States, launched its cryptocurrency custody service for corporate executives. The high demand of corporate investment managers has been driven in the last few years.

Similarly, Bank of America, another bank that Baft has invested in, launched a research division in October last year citing the growing interest of organizations in the crypto sector.

A few months ago, BNY Mellon announced that it would offer asset management, custody, transfer,… bitcoin and other cryptocurrencies to its customers.